The PA Chamber achieved major, long-fought wins for Pennsylvania’s economy in the 2022-23 state budget that will instantly make our state more competitive, incentivize investment and job growth and set us up for incredible economic opportunities in the years to come.

The PA Chamber achieved major, long-fought wins for Pennsylvania’s economy in the 2022-23 state budget that will instantly make our state more competitive, incentivize investment and job growth and set us up for incredible economic opportunities in the years to come.

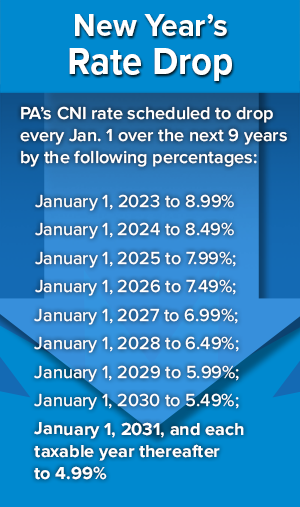

Working alongside a bipartisan group of lawmakers, our local chamber partners and Gov. Tom Wolf, we secured a reduction in Pennsylvania’s Corporate Net Income Tax rate! Our 9.99 percent CNI – which has been the highest flat rate in the country – will be reduced to 8.99 percent on Jan. 1, 2023, with automatic, annual .50 percentage point reductions until the rate reaches 4.99 percent in 2031.

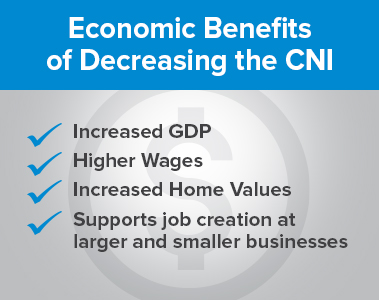

Based on current state corporate tax rates, the full reduction takes PA from the HIGHEST FLAT CNI rate in the country to the EIGHTH LOWEST by 2031 and is the first change in the rate since 1995 – giving our economy a vigorous boost in our post-pandemic recovery.

Reducing the CNI was the PA Chamber’s No. 1 tax reform priority for decades, and for good reason – a 9.99 percent CNI raised a huge red flag to any would-be investors. With the long-awaited reduction in place, Pennsylvania can finally cast aside what had stood out as a detractor to doing business here.

Instead, we’ll focus on touting the many assets our state has to offer as we work together for Pennsylvania toward a post-pandemic future that is primed for economic greatness: our location (within an 8-hour drive of 60 percent of the nation’s population); our vast natural resources, including domestic energy resources that are needed more than ever; our innovative spirit and strong work ethic; our world-class educational institutions; and more.

Instead, we’ll focus on touting the many assets our state has to offer as we work together for Pennsylvania toward a post-pandemic future that is primed for economic greatness: our location (within an 8-hour drive of 60 percent of the nation’s population); our vast natural resources, including domestic energy resources that are needed more than ever; our innovative spirit and strong work ethic; our world-class educational institutions; and more.

Small Biz Benefits

While the reduction in PA’s Corporate Net Income Tax rate is a dream come true for the state’s business community and a major achievement for the PA Chamber, we realize that most Pennsylvania employers are small businesses that don’t pay the CNI and are subject to the Personal Income Tax rate. That’s why we’re pleased to report that there are other victories in this budget that benefit businesses across the board. Here’s some other wins we scored with bipartisan lawmakers coming Together for PA on behalf of the state’s small to mid-sized employer community in FY 2022-23:

– Like-Kind Exchanges: Letting employers dispose one asset and acquire another without generating a tax liability from the sale of the first asset. Pennsylvania was the only state in the country that didn’t allow for this tax deferral at the state level.

– Tax Deduction for Qualifying Equipment Purchases: Section 179 of the Federal tax code allows owners of pass-through businesses to take a tax deduction for the total purchase price of qualifying equipment. Pennsylvania law limited the deductions for businesses subject to the state personal income tax. This measure provides equity for small businesses, increasing the current deduction limit to be consistent with the federal limit.

Forward-Focused

Building a more robust economy in Pennsylvania means implementing a tax structure that attracts businesses of all sizes. On behalf of our broad-based membership, the PA Chamber is working in a bipartisan fashion with lawmakers in Harrisburg, coming Together for PA to implement the following additional tax policy priorities and truly drive our state toward the economic greatness our citizens deserve:

implement the following additional tax policy priorities and truly drive our state toward the economic greatness our citizens deserve:

– Eliminating the cap on Net Operating Loss Carryforwards, which will especially help smaller start up and cyclical businesses in leaner times of operation

– Working to ensure that taxes are as transparent and predictable as possible and streamlined with federal law when appropriate

– Administrative reforms that promote timely, efficient and independent tax dispute resolution

Click the banner below to download a budget overview (pdf)