The PA Chamber is always working to counter the threat of undue tax increases on businesses. And while tax hikes can pose challenges for all businesses, they’re particularly burdensome for small-sized companies that do not have the financial bandwidth to absorb them – especially in an economy that is plagued with inflationary pressures.

The PA Chamber is always working to counter the threat of undue tax increases on businesses. And while tax hikes can pose challenges for all businesses, they’re particularly burdensome for small-sized companies that do not have the financial bandwidth to absorb them – especially in an economy that is plagued with inflationary pressures.

We cautioned House Democrats against imposing these tax burdens when they recently unveiled what they call the “Fair Share Tax Plan,” legislation that would quadruple the tax rate for small businesses throughout the Commonwealth. House Democrats recently held a hearing on the legislation, which, if enacted, would raise taxes on the nearly 180,000 small businesses operating in Pennsylvania including S-corporations, partnerships, and sole proprietors, from the current rate of 3.07 percent to a staggering 12 percent – a 300 percent increase!

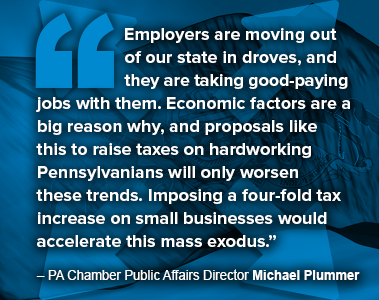

The PA Chamber is leading the effort to push back against H.B. 1773. In a series of articles published by Broad + Liberty, the Center Square, and the Central Penn Business Journal, PA Chamber Director of Public Affairs Michael Plummer said this legislation would “sabotage our economic competitiveness and undermine bipartisan efforts to attract and retain businesses in Pennsylvania.” Instead of pushing forward this harmful legislation, the PA Chamber is promoting policies that support small business growth and foster a more competitive business environment, like improving the treatment of Net Operating Losses.

These testimonies might not be what supporters of the legislation want to hear – but they need to hear them. Small businesses are the cultural and economic fabric of every Pennsylvania community, and a sound economy is what’s necessary for them to survive. We urge every state lawmaker to hear the legitimate concerns of these employers and consider alternative, pro-growth policies that will drive revenue to the Commonwealth and strengthen employers’ bottom lines, job seekers’ opportunities, and communities as a whole.