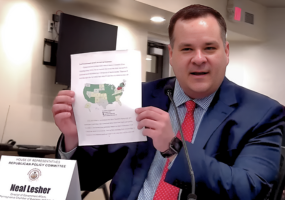

PA Chamber Director of Government Affairs Neal Lesher testified before the PA House GOP Policy Committee last week in a series of public hearings focused on business tax reform.

PA Chamber Director of Government Affairs Neal Lesher testified before the PA House GOP Policy Committee last week in a series of public hearings focused on business tax reform.

In his testimony, Lesher outlined Pennsylvania’s “uniquely harsh” business tax and regulatory climate and the detrimental effects these factors have on the state’s workforce and job retention.

Lesher cited a recent study by WalletHub which identified Pennsylvania as the fifth worst state in the nation to find a job, as well as several independent analyses which placed the Commonwealth in the bottom third of states for key economic indicators.

“As a corollary, businesses and people are fleeing Pennsylvania,” Lesher testified. “And they are taking good-paying jobs with them.”

To reverse this trend, Lesher suggested lawmakers should continue building on the bipartisan progress made last session, particularly Act 53 – which, upon enactment, initiated a gradual phasedown of the corporate net income (CNI) tax rate from 9.99 percent to 4.99 percent.

“When that phasedown is complete in 2031, we will have gone from the second-highest corporate net income tax [in America] to the eighth lowest,” Lesher said. “At the same time, though, we know we’re not the only state that is looking at pro-growth reforms.”

Lesher identified 10 other states that have reduced their corporate net income taxes since 2022 and emphasized the urgency of Pennsylvania keeping its tax climate competitive.

Pennsylvania’s treatment of Net Operating Losses (NOLs) was also a central part of the discussion. Lesher noted that Pennsylvania is one of only two states nationwide with stricter rules governing the portion of taxable losses businesses are permitted to carry forward than the federal government. In effect, this is a tax on businesses looking to grow and start in Pennsylvania.

While the Internal Revenue Service (IRS) permits companies that have experienced net revenue losses in a previous tax year to carry forward those losses and deduct up to 80 percent of their taxable income when they finally do turn in a profit , Pennsylvania limits employers’ NOL deductions to just 40 percent. Lesher recommended increasing the state’s cap on NOLs to align Pennsylvania’s treatment of these losses with the federal rules.

“We think that’s a common-sense policy that puts us in line with other states,” Lesher said, further arguing that such a change would benefit startups and businesses operating in cyclical industries.

In addition to advocating for more business-friendly tax policies, Lesher cautioned lawmakers against punitive measures that could hinder Pennsylvania’s business environment. He criticized proposals such as combined reporting and tax rate hikes on small businesses, emphasizing the need for tax policies that promote economic growth.

Lesher also proposed small business tax reforms – including repealing the accelerated sales tax requirement and allowing full expensing of equipment investments – designed to enhance the state’s business climate while fostering additional private sector investment and job creation.

Lesher concluded by urging policymakers to prioritize pro-growth initiatives to unlock Pennsylvania’s economic potential, emphasizing the Commonwealth’s abundant resources, skilled workforce, and innovation capabilities. He underscored the importance of reforming the state’s tax structure to ensure Pennsylvania can compete with other states for economic growth and opportunities.

To watch Lesher’s full testimony, click here.