Most lawmakers recognize that small businesses are our state’s economic backbone, cultural drivers and job creators in their local communities. But some of them continue to promote policies that are historically proven to hurt those same small businesses and, maybe worse, the people who benefit from the jobs they create.

A few weeks ago, another push to raise the minimum wage to $15 an hour was started by Gov. Tom Wolf and several lawmakers at an event in Philadelphia. Getting more money into the hands of workers is a laudable goal, but nonpartisan studies show that by raising the wage to even $12 an hour, employers would see a 65 percent increase in their operating costs.

Another element of the Governor’s latest proposal, the elimination with the tipped wage, would force close to a 500 percent wage hike on restaurants at the same time they’re emerging from COVID-19’s economic devastation.

The answer to these skyrocketing labor costs is always the same: fewer jobs, fewer businesses, and less opportunity.

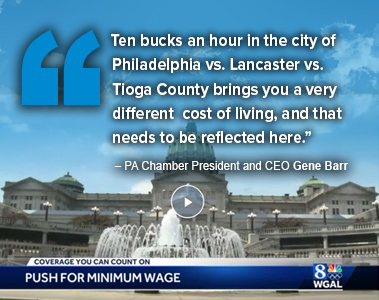

The reality is that many businesses offer well above the minimum wage, and in some cases are even offering signing bonuses in an effort to get people back to work. That means that the mandate would be negatively targeted toward small business owners, particularly those who live in more rural areas of the Commonwealth with lower costs of living.

The reality is that many businesses offer well above the minimum wage, and in some cases are even offering signing bonuses in an effort to get people back to work. That means that the mandate would be negatively targeted toward small business owners, particularly those who live in more rural areas of the Commonwealth with lower costs of living.

Another key fact: minimum wage earners rarely fit the demographic that proponents would have you believe. Across the nation, only 1.8 percent of workers over 25 earn at or below $7.25 per hour and the latest numbers from the state Department of Labor and Industry show that fewer than 75,000 Pennsylvanians made the minimum wage or less in 2020. Of those, the majority are under the age of 25, do not have children and live in households with where the annual income is between $75,000 to $100,000 a year.

Simply put, the minimum wage is meant to be a starting wage – not a wage workers stay at for the whole of their career. In order to give these workers a true opportunity to improve their earning potential, the PA Chamber believes there are better alternatives – including career-oriented job training or an Earned Income Tax Credit to spread the cost of financial aid for low-income workers over the entire taxable population, instead of relying on employers to foot the bill entirely. Our organization continues to promote these alternatives while continuing our years-long battle against misguided wage mandates.

Simply put, the minimum wage is meant to be a starting wage – not a wage workers stay at for the whole of their career. In order to give these workers a true opportunity to improve their earning potential, the PA Chamber believes there are better alternatives – including career-oriented job training or an Earned Income Tax Credit to spread the cost of financial aid for low-income workers over the entire taxable population, instead of relying on employers to foot the bill entirely. Our organization continues to promote these alternatives while continuing our years-long battle against misguided wage mandates.