The 2021-22 state budget agreed to by lawmakers and Gov. Tom Wolf last week includes welcomed news for employers statewide – a looming, onerous Overtime Rule that the Department of Labor and Industry had set to take effect is no longer on the table.

A part of the final deal was the total repeal of an effort initially undertaken by the Wolf administration in 2018 to aggressively expand the range of employees eligible for overtime pay – the requirement that businesses pay time-and-a-half for every hour an employee works in a given week. For years, our organization has been at the forefront in opposing this rule for the negative impact it would have on employers and workers. We’ve told lawmakers of the struggles our members have said they would face if forced to comply with such a dramatic shift – including converting salaried employees to hourly so hours could be tracked and capped each week – leading to the loss of coveted flexibility and benefits. We also led a coalition that included nonprofits, higher education, healthcare institutions and the restaurant industry to voice our collective opposition to this anti-business rule.

Despite a long-running history of frustration regarding the rule – Concurrent Resolutions of disapproval were adopted by the General Assembly only to be vetoed by Gov. Wolf – a simple one-sentence line in this year’s budget deal eliminated the Overtime Rule and with it, employers’ fear that they would be forced to adhere to a stricter, much more costly set of operating standards as they work toward economic recovery from the pandemic.

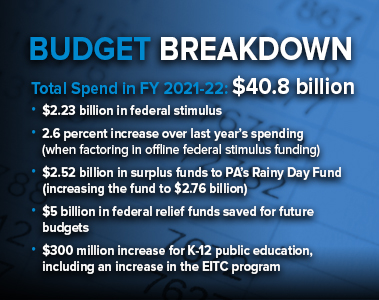

Notably, the nearly $40 billion spending plan does not impose any new tax increases on employers, nor does it include a spike in the Personal Income Tax that was a critical element of the governor’s initial budget proposal. The influx of $7 billion in pandemic-related federal stimulus aid – along with months of higher than anticipated revenue collections – helped the negotiations move along to culminate in a timely, fiscally responsible budget.

Notably, the nearly $40 billion spending plan does not impose any new tax increases on employers, nor does it include a spike in the Personal Income Tax that was a critical element of the governor’s initial budget proposal. The influx of $7 billion in pandemic-related federal stimulus aid – along with months of higher than anticipated revenue collections – helped the negotiations move along to culminate in a timely, fiscally responsible budget.

The PA Chamber applauded lawmakers for enacting a state budget that recognizes the challenges taxpayers and businesses face today. Yet, even with the elimination of the Overtime Rule and a no-tax-hike budget, much more needs to be done to not only ensure that Pennsylvania can continue down the path to financial recovery but become more competitive. This includes reducing the state’s uncompetitive Corporate Net Income tax rate, which at 9.99 percent remains among the nation’s highest – a point recently noted by Senate President Pro Tempore Jake Corman, who called the CNI a “blinking light” for would-be economic developers who “won’t even consider coming to Pennsylvania.”

The PA Chamber applauded lawmakers for enacting a state budget that recognizes the challenges taxpayers and businesses face today. Yet, even with the elimination of the Overtime Rule and a no-tax-hike budget, much more needs to be done to not only ensure that Pennsylvania can continue down the path to financial recovery but become more competitive. This includes reducing the state’s uncompetitive Corporate Net Income tax rate, which at 9.99 percent remains among the nation’s highest – a point recently noted by Senate President Pro Tempore Jake Corman, who called the CNI a “blinking light” for would-be economic developers who “won’t even consider coming to Pennsylvania.”

As part of our “Bringing PA Back” initiative, the PA Chamber is promoting policy solutions that will attract and retain the talent that will make Pennsylvania a world-class economy in the 21st century. You can read more about these initiatives at http://www.BringingPABack.com/public-policy.