The PA Chamber closely monitors how legislation would impact our members’ bottom line, and that’s especially true during budget season. Earlier this month, Gov. Josh Shapiro delivered his highly anticipated first budget address – one that he was quick to call a “starting point” as months-long negotiations get underway for the 2023-24 Fiscal Year that will begin on July 1. Budget hearings have since kicked off, with the House and Senate Appropriations Committees holding public hearings with the heads of state agencies and other entities that receive government funding to discuss the coming year’s budget.

The PA Chamber closely monitors how legislation would impact our members’ bottom line, and that’s especially true during budget season. Earlier this month, Gov. Josh Shapiro delivered his highly anticipated first budget address – one that he was quick to call a “starting point” as months-long negotiations get underway for the 2023-24 Fiscal Year that will begin on July 1. Budget hearings have since kicked off, with the House and Senate Appropriations Committees holding public hearings with the heads of state agencies and other entities that receive government funding to discuss the coming year’s budget.

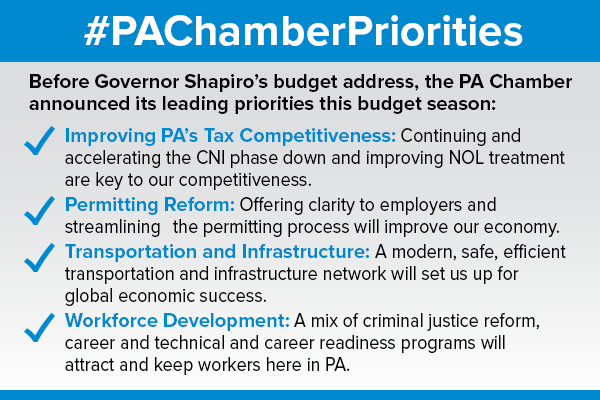

The PA Chamber looks forward to working with elected officials to enact a budget that will elevate Pennsylvania’s competitive standing and impose the least possible burden on employers who are still grappling with pandemic-era challenges while they work to create jobs and improve our economy.

Here are some highlights from Gov. Shapiro’s $44.4 billion budget proposal, which is an 8 percent increase over the current year (not including $930 million that he wants to move into a separate fund for the State Police):

Proposed Changes in PA Tax Structure

While the governor supports the continued phase down of the Corporate Net Income Tax (which went from 9.99 percent to 8.99 percent this year) and has expressed support for speeding up the phase-down, his plan doesn’t include an accelerated CNI reduction. The PA Chamber will continue to promote continuing and accelerating the CNI phase down to improve our state’s competitiveness.

While he called for eliminating the sales tax and gross receipts tax on cell phones, which would save $62 million, Gov. Shapiro also called for increasing the 911 surcharge from $1.65 to $2.03, which would generate an additional $54 million in revenue.

He also called for an increase in the income limit for Property Tax Rent Rebates from $35,000 or less for homeowners and $15,000 or less for renters to $45,000 or less for both, which would expand the program to an additional 173,000 seniors and persons with disabilities. The income limits would also be indexed to inflation.

Public Safety and Transportation Funding

The governor proposed establishing a roughly $1 billion new fund for the State Police, funded through existing General Fund revenue sources, as opposed to the current approach of diverting money from the Motor License Fund. In doing so, the governor would reduce the amount of MLF money going to support the State Police by $100 million a year, until it is eliminated in FY 2027-28. According to the administration, this provides for the full matching requirements over the next five years necessary to qualify for additional federal funding for highways and bridges made available by the federal Infrastructure Investment and Jobs Act. The Governor’s proposal does not contemplate any changes to the structure of the state’s tax on sales of motor fuels.

Permitting Reform

The governor is requesting additional funding to support staffing and operations of the Governor’s Office of Transformation and Opportunity, which includes the one-stop shop for key development projects to efficiently obtain state permits. The governor also said that the permitting process takes too long and that he is charging agencies to define by May 1 expected response times for all permits to establish a “money back guarantee” if a decision is not made by then. The governor is also seeking increased funding for DEP and DCNR to hire more permitting staff as well as to develop modeling for carbon capture sequestration in support of securing federal funding for a hydrogen hub in the state.

Education Spending

Total PreK-12 education spending would increase by almost $900 million or 5.6 percent. That includes a $567 million increase in basic education funding, an 8 percent increase; as well as a $104 million increase for special education; a new $100 million block grant to provide mental health services in schools; and a new $100 million grant program for school environmental improvement capital projects.

Higher Education would receive a $60 million increase with a 7.1 percent increase for Penn State, Pitt, Temple, and Lincoln universities; and a 2 percent increase for the State System of Higher Education, the Thaddeus Stevens College of Technology, and community colleges.

Workforce Development

The proposal includes increased funding for existing workforce development programs, including a $14 million, or 13.3 percent, increase for career and technical education and a $2.5 million increase to the apprenticeship training program through the Department of Labor and Industry. He also proposed two new programs: a $3 million appropriation to the Foundations in Industry program through the Department of Community and Economic Development would increase apprenticeship and pre-apprenticeship programs; and a $3.5 million appropriation to the Schools-to-Work program through the Department of Labor & Industry would support partnerships between career and technical education students and employers.

Proposed Mandated Minimum Wage Increase

The governor proposed increasing the minimum wage from $7.25 to $15/hour effective January 1, 2024. The proposal does not include any other details, including any references to the tip credit.

Recreational Marijuana

The proposal would legalize adult use cannabis and assess a 20 percent wholesale tax, which he projects would generate $28 million in the first year, increasing to $250 million by FY2027-28.

Labor Law Compliance

The proposal increases funding by $1.28 million to hire additional labor law compliance investigators within the Department of Labor and Industry to investigate more cases, allow for more strategic enforcement of current laws, and provide additional education for businesses.

Unemployment Compensation

The proposal reauthorizes the Service and Infrastructure Improvement Fund (SIIF), which was established in 2013 and provided for a temporary diversion of employee taxes in order to fund technology infrastructure upgrades. This new authorization is intended to fund 50 new UC Service Center positions.

The PA Chamber will be engaged through the entirety of the budget process and is ready and eager to answer your questions! Please contact our team about these or any other issues.