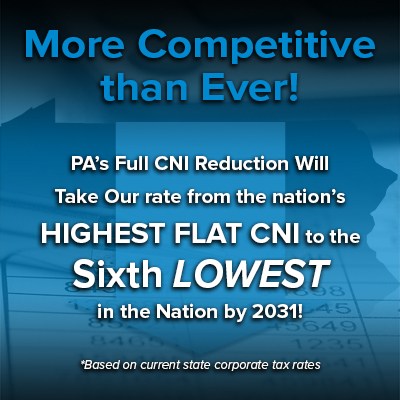

Pennsylvania’s economic future looks bright! Last week, as the 2022-23 state budget was being passed, a long-time PA Chamber-led effort to reduce the state’s Corporate Net Income Tax rate finally came to fruition. At 9.99 percent, our CNI is the highest flat rate in the country and for decades has stood as a major barrier to business investment and job growth. Thanks to our efforts and in working alongside our local chamber partners, bipartisan lawmakers and Gov. Tom Wolf who signed the bill into law, the CNI will be cut IN HALF over the next nine years. This will start on Jan. 1, 2023 with a full 1 percent reduction to 8.99 percent, with automatic, annual .50 percentage point reductions until the rate reaches 4.99 percent in 2031.

Pennsylvania’s economic future looks bright! Last week, as the 2022-23 state budget was being passed, a long-time PA Chamber-led effort to reduce the state’s Corporate Net Income Tax rate finally came to fruition. At 9.99 percent, our CNI is the highest flat rate in the country and for decades has stood as a major barrier to business investment and job growth. Thanks to our efforts and in working alongside our local chamber partners, bipartisan lawmakers and Gov. Tom Wolf who signed the bill into law, the CNI will be cut IN HALF over the next nine years. This will start on Jan. 1, 2023 with a full 1 percent reduction to 8.99 percent, with automatic, annual .50 percentage point reductions until the rate reaches 4.99 percent in 2031.

A lower CNI won’t just generate more overall investment. Studies show economic gains across the board when the CNI is reduced including increased GDP, higher wages, increased home values and job creation at larger AND smaller businesses.

While the reduction in the Commonwealth’s CNI is a long-fought achievement for the state’s business community, we realize that most Pennsylvania employers are small businesses that don’t pay the CNI and are subject to the Personal Income Tax rate. That’s why we’re pleased to report that there are other victories in this budget that benefit businesses across the board. Here’s some other wins we scored with bipartisan lawmakers coming Together for PA on behalf of the state’s small to mid-sized employer community in FY 2022-23:

- Like-Kind Exchanges: Letting employers dispose one asset and acquire another without generating a tax liability from the sale of the first asset. Pennsylvania was the only state in the country that didn’t allow for this tax deferral at the state level.

- Tax Deduction for Qualifying Equipment Purchases: Section 179 of the Federal tax code allows owners of pass-through businesses to take a tax deduction for the total purchase price of qualifying equipment.

Pennsylvania law limited the deductions for businesses subject to the state personal income tax. This measure provides equity for small businesses, increasing the current deduction limit to be consistent with the federal limit.

Pennsylvania law limited the deductions for businesses subject to the state personal income tax. This measure provides equity for small businesses, increasing the current deduction limit to be consistent with the federal limit.

In a press release following the General Assembly’s passage of this game-changing tax reforms package, PA Chamber President and CEO Luke Bernstein applauded state lawmakers and Gov. Tom Wolf for coming together and putting Pennsylvania’s economic future and its people first.

“These tax reforms instantly make us more competitive and allow us to focus on Pennsylvania’s strengths as a hub of global commerce and opportunity – our prime location, world-class educational institutions, innovative workforce and more,” he said. “We are proud to stand with the leaders of the House and Senate, Governor Wolf and other legislative champions of business who supported these vast improvements to our state’s competitiveness. This tax reform package, which was a top legislative priority for our organization for decades, is a major step towards showing that Pennsylvania is open for business and ready to chart a path toward a bright future for our state’s economy.”