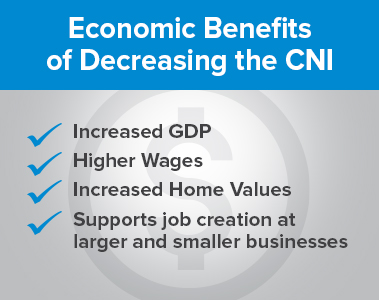

The PA Chamber joined Gov. Wolf and leaders from the General Assembly last week to commemorate the significance of recently enacted reforms to the state’s tax code. These reforms, including a scheduled phasedown of the Corporate Net Income Tax (CNIT) over the next nine years and pro-growth changes to tax law for small businesses, make the state more competitive, will incentivize investment and job growth, and set Pennsylvania up for incredible economic opportunities in the years to come.

The joint release from the PA Chamber includes perspectives from Republican and Democratic leaders in both the Pennsylvania House and Senate who helped enact tax reform during the recent budget negotiations, including House Speaker Bryan Cutler, Senate Majority Leader Kim Ward, House Majority Leader Kerry Benninghoff, House Minority Leader Joanna McClinton, and others.

The PA Chamber will continue to work in a bipartisan fashion with lawmakers in Harrisburg, coming Together for PA to implement additional tax policy changes to truly drive our state forward. These include improving the treatment of – and ultimately eliminating – the cap on net operating loss cap, and enacting reforms that promote timely, efficient and independent tax dispute resolution.